Bloomberg News just reported that the SEC voted 3-2 to sue Goldman Sachs for fraud:

April 19 (Bloomberg) — The U.S. Securities and Exchange Commission split 3-2 along party lines to approve an enforcement case against Goldman Sachs Group Inc., according to two people with knowledge of the vote.

SEC Chairman Mary Schapiro sided with Democrats Luis Aguilar and Elisse Walter to approve the case, said the people, who declined to be identified because the vote wasn’t public. Republican commissioners Kathleen Casey and Troy Paredesvoted against suing, the person said.

It’s clever: President Obama gets to run against the Giant Vampire Squid in November with the Republicans floundering in a defense of a rather tarnished free market. On the heels of the SEC announcement, Obama intoned in his Saturday radio address: “”Every day we don’t act, the same system that led to bailouts remains in place, with the exact same loopholes and the exact same liabilities. And if we don’t change what led to the crisis, we’ll doom ourselves to repeat it.”

The widespread accusation that the financial industry has undue influence over the government,repeated prominently in the Atlantic Magazine by former IMF chief economist Simon Johnson, appears refuted. If, as I suspect, the GS case is the thin end of the wedge, the administration will silence its critics on the left, ram through regulatory reform, and demonstrate that it isn’t the financial industry that’s taken over the government — it’s the government that’s taken over the financial industry.

Simon Johnson wrote in the linked article:

But there’s a deeper and more disturbing similarity [between the US and emerging markets]: elite business interests—financiers, in the case of the U.S.—played a central role in creating the crisis, making ever-larger gambles, with the implicit backing of the government, until the inevitable collapse. More alarming, they are now using their influence to prevent precisely the sorts of reforms that are needed, and fast, to pull the economy out of its nosedive. The government seems helpless, or unwilling, to act against them.

It doesn’t seem likely that the financial industry will put up a successful resistance to regulatory reform now.

The Senate Republicans unanimously oppose the administration’s plan to increase regulation of the financial industry, especially of over-the-counter derivatives. But they are throwing themselves in front of the barn door long after the horses have bolted. Mortgage securitization was a critical ingredient in the Reagan recovery mix back in the 1980s: not only did it promote home ownership, but it made it possible for entrepreneurs to turn their homes into working capital. Of course, it also made it easier for households to take the levered bets on home prices that went sour in 2007.

The housing market is down for the duration. As I wrote in the May 2009 edition of First Things:

In 1973, the United States had 36 million housing units with three or more bedrooms, not many more than the number of two-parent families with children–which means that the supply of family homes was roughly in line with the number of families. By 2005, the number of housing units with three or more bedrooms had doubled to 72 million, though America had the same number of two-parent families with children.

Americans had a financial incentive (tax breaks and low interest rates) to buy more house than they needed. It will take years to work off the excess, and some regions will be filled with derelict developments for a generation.

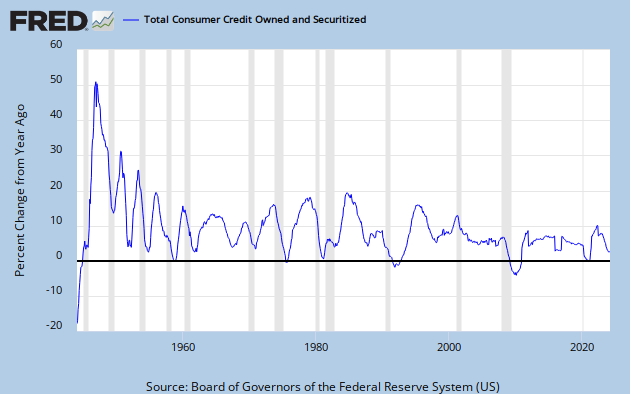

Asset-backed securities spurred the expansion of auto loans and credit cards, but consumer credit is shrinking at the fastest pace since World War II.

There is one other major sector in the Collateralized Debt Obligation market, namely credit: investment banks package lower-rated, risky credits into CDO’s which distribute default risk to investors with varying risk appetites in different tranches. The main purpose of the credit-backed CDO market was to finance Leveraged Buy-Outs (LBOs), geared up the balance sheets of US corporations.

All this is moot. The US is financing a federal deficit equal to 12%-13% of GDP with a saving rate of just 3%, because the banking system is absorbing the flood of Treasury debt issuance. Banks borrow at next to nothing and buy 2-year Treasury notes at around 1% interest, and lever the trade as much as the regulators will let them. Foreign banks (which might be offshore subsidiaries of US banks) have been buying $50 to $60 billion a month of US Treasury securities. Nothing like this ever has been seen int he US, although we saw it in Japan during the “lost decade” of the 1990s.

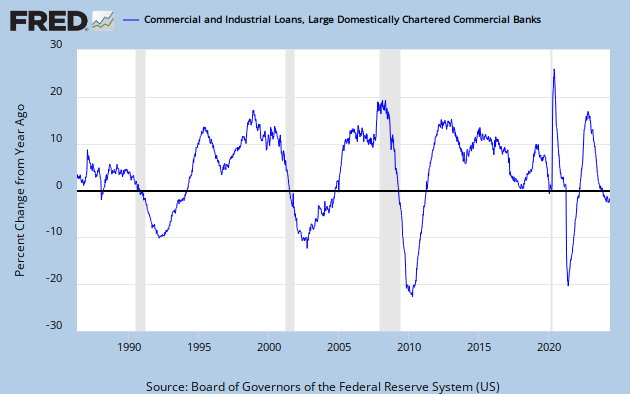

Banks can make decent money with zero percent financing from the central bank and a steep yield curve (they get paid a lot for lending a little longer than they borrow). That is to say that banks can make as much money as the Federal Reserve permits them to make. Meanwhile bank loan books are shrinking at a staggering 20% annual rate, again the fastest in history:

Small business is doing terribly, with the National Federation of Independent Business and Discover Small Business Watch indices at their lowest level in many months. There’s no money for small business. Neither is there any money for enterpreneurs.

The first quarter of 2010 saw the lowest commitments to venture capital since 1993, says the National Venture Capital Association:

Though rising numbers from the final quarter for 2009 had many hopeful that 2010 would see a rebound of venture capital funds, new data from the Nation Venture Capital Association (NVCA) is bound to disappoint as Q1 2010 saw the lowest first quarter numbers (PDF) in 17 years. According to the NVCA, just $3.6 billion has been raised so far this year by VCs compared to $5.2 billion in 2009 and $7.1 billion 2008.

Back in January, we postulated that the uptake in fundraising by VCs during the final quarter of 2009 could lead to increased VC spending in 2010. The first quarter did see record breaking merger and acquisition numbers, but as NVCA president Mark Heesen points out, the IPO market continued to struggle - a fact he says may have contributed to the new low numbers for VC funds.

And the global IPO market was down 19% during the first quarter compared to the fourth quarter of 2009.

The Giant Vampire Squid has been eaten by Leviathan: an all-encompassing Hobbesian state that centralizes credit in the hands of the federal government. We will have Japan, in a nutshell.

What’s the alternative? Financial regulation is not the issue: the damage already has been done. More CDO’s aren’t going to fix the problem. There won’t be much of a mortgage CDO market for years to come in any case, and the credit CDO market only helped force air into corporate balance sheets.

What the US needs is free market financing for entrepreneurs. And that’s best achieved through the tax system.

To avoid sinking into a European or Japanese profile of permanent stagnation and permanently high unemployment, America should eliminate all taxes on capital income and replace the lost revenue by taxing consumption (I personally like a big hydrocarbons tax). Forget double taxation of dividends and the tax advantages of debt (which accounts for the explosion of debt as opposed to new equity offerings). Get rid of ALL taxation of dividends and interest, as well as capital gains. Period. Give American entrepreneurs a chance to raise risk capital from the market.

Dear Reader,

You have a decision to make: double or nothing.

For this week only, a generous supporter has offered to fully match all new and increased donations to First Things up to $60,000.

In other words, your gift of $50 unlocks $100 for First Things, your gift of $100 unlocks $200, and so on, up to a total of $120,000. But if you don’t give, nothing.

So what will it be, dear reader: double, or nothing?

Make your year-end gift go twice as far for First Things by giving now.