Like the New Guinea primitives who built straw airfields after the departure of American forces to bring “cargo” down from the heavens, Americans wait for the business cycle to turn. They will wait a long time. The Obama administration is administrating the economic equivalent of barbiturates to a near-comatose patient, as I wrote this morning over at the First Thoughts blog.

And my Top 10 Reasons to fade the recovery appeared yesterday on my “Inner Workings” blog at Asia Times:

10) There is no recovery at all in Europe. European growth ground to a halt during the fourth quarter and German busines confidence unexpectedly fell in February.

9) China won’t collapse, but government efforts to stop overheatingby raising reserve requirements make clear that the world’s second-largest economy can’t be the locomotive for world growth.

8. Greece and its prospective rescuers in the European Community are at loggerheads over conditions for EC help. “Greece faces several important challenges in the coming days, including an expected bond auction, a planned general strike on Wednesday, and a visit from European Union officials that began Monday, aimed at pushing the country to take tougher steps to rein in its budget deficit,” WSJ reported today.

7. State fiscal crises continue to worsen. “Doomsday is here for the state of Illinois,” California’s last set of cosmetic measures do little to address a $20 billion deficit, Baltimore has no idea how to close a $120 billion deficit. On top of this year’s $200 billion deficit, states face a trillion-dollar shortfall in pension funds.

6) Commercial real estate is nowhere near bottom, with some sectors (e.g. hotels) at delinquency rates of nearly 10%. Credit Suisse says that delinquencies could reach $60 billion.

5) Regional banks continue to drop like flies, with 702 banks holding assets of $403 billion on the danger list.

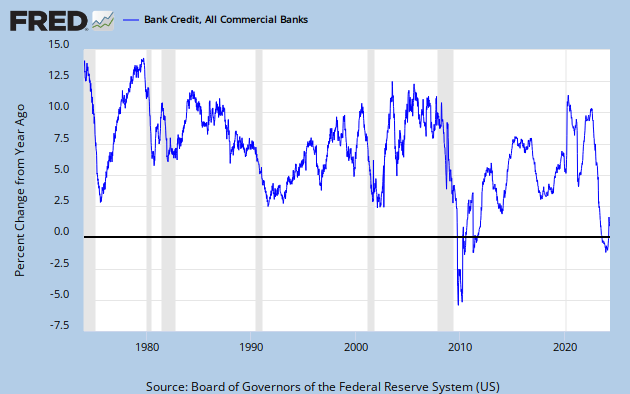

4) Bank credit continues to shrink. Total bank credit is still falling at a 5% annual rate, an unprecedented decline:

3) What bank credit is available is funding the US Treasury deficit in the mother of all crowdings-out, replacing commercial loans on banks’ balance sheets:

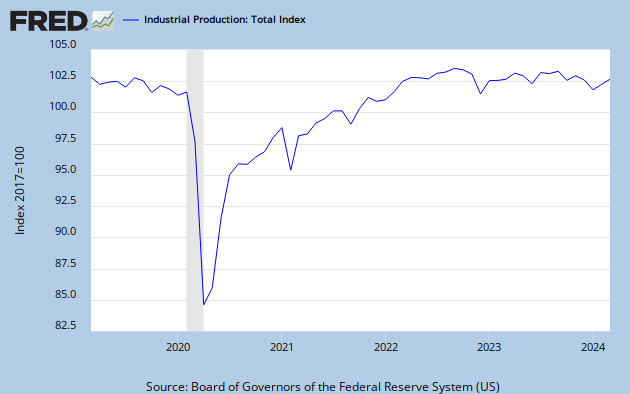

2) Industrial production has bounced of the bottom, but manufacturing is only 15% of US employment.

And Dave’s top reason to fade the recovery is

1) Employment won’t come back. Today’s consumer confidence number is one more nail in the coffin of exaggerated hopes for a cyclical recovery.

You have a decision to make: double or nothing.

For this week only, a generous supporter has offered to fully match all new and increased donations to First Things up to $60,000.

In other words, your gift of $50 unlocks $100 for First Things, your gift of $100 unlocks $200, and so on, up to a total of $120,000. But if you don’t give, nothing.

So what will it be, dear reader: double, or nothing?

Make your year-end gift go twice as far for First Things by giving now.